Need a new Current Account?

Switching is easy with Current Account from your Credit Union.Open your

Current Account:

- Drop into or call a participating credit union. You can find participating credit unions here.

- If you are already registered for online banking with one of our Credit Unions, you can open your Current Account online.

- Provide your Credit Union with suitable documentation to verify your identity and your current permanent address (such as a passport or driving licence and an up to date utility bill or recent bank statement)

- Sign the relevant application forms and we’ll do the rest.

- We will open your new current account, assist you to set you up on our Banking App, provide you with your current account details and order you a Debit Mastercard.

- Let us know if you require an Overdraft and we’ll process your application speedily. ( Lending criteria, terms and conditions apply).

- We can organise for you to become a member of the Credit Union at the same time as opening your account.

Switch your Current Account to your Credit Union:

Once you’ve opened your Credit Union current account, we will organise the switch for you:

- We will set up all your active standing orders on your new account.

- We will arrange with your ‘old bank’ to contact your Direct Debit originators to advise them of your new Current Account details.

Our Switcher Pack has all the information you will need. Make sure to pick up a Switcher Pack in your Credit Union when you are opening your new Current Account.

You simply complete the Switcher Forms and we will look after everything after that.

We have dedicated Switching Officers and any member of staff will be able to guide you through the process.

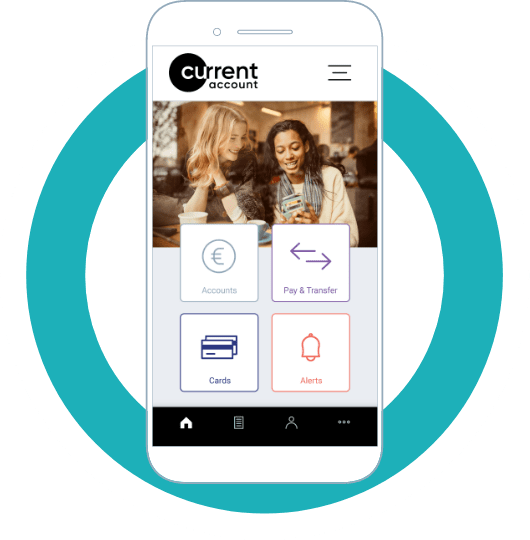

Current Account

Features & Benefits

- Easy to sign up

- Same friendly service

- Low and transparent fees

- Globally accepted Mastercard® Debit Card

- Contactless payment

- Apple pay, Google Pay™, Google Wallet™

- Secure online shopping

- In-store, online or at ATMs

- Cash back available

- Automate regular payments with Standing Orders & Direct Debits

- Overdraft for unexpected expenses

(lending criteria, terms and conditions apply)

With Current Account’s low and transparent fees, we make it straightforward and clear on pricing. All you need pay is €4 per month*.

| Free | €4/per month | |

|---|---|---|

| Debit Card Point of Sale & Contactless transactions in Euro | yes | |

| Direct Debit and Standing Order processing | yes | |

| Electronic payments into and out of your account | yes | |

| Mobile and internet banking | yes | |

| Quarterly eStatements | yes | |

| Up to 5 ATM withdrawals per month | yes | |

| Monthly Account Maintenance Fee charged quarterly | yes |

Talk to one of our participating Credit Unions today

Only available at participating Credit Unions. Terms and Conditions apply. 5 ATM euro cash withdrawals are included in the €4 monthly fee. Any additional ATM cash withdrawals in the month are charged .50 cent. Other charges apply for things like Government Stamp Duty on your debit card, unpaid items, or if you use an ATM outside the Eurozone. Full details of Fees & Charges available here.